New Year’s Resolution: Improve your Health (Savings Account)

Happy New Year! As you kick off 2023 with major motivation to meet your resolutions, we have another goal for you to add to your vision board: Taking advantage of your HSA!

An HSA is an account you can pair with a high-deductible health insurance plan to cover medical expenses that arise throughout the year. All the money that goes into this account is pre-taxed, which is especially appealing. It is really the only way to deduct out-of-pocket medical expenses, and it carries over from year to year, so it pays (literally) to fully fund your HSA each year to save money on your taxes.

If you have an HSA through your employer, you can make a pre-tax payroll contribution, which saves more on taxes than deductible after-tax contributions. Spending your HSA money on qualified medical expenses is free of federal income taxes. Even better, if you invest some of your HSA money, any growth is also tax-free. And at AccountAbility, we know you love tax-free money!

If you're excited about contributing to an account and saving money, but your employer doesn't offer an HSA, you can sign up for your own. We recommend looking at local credit unions, as they often charge lower fees than banks.

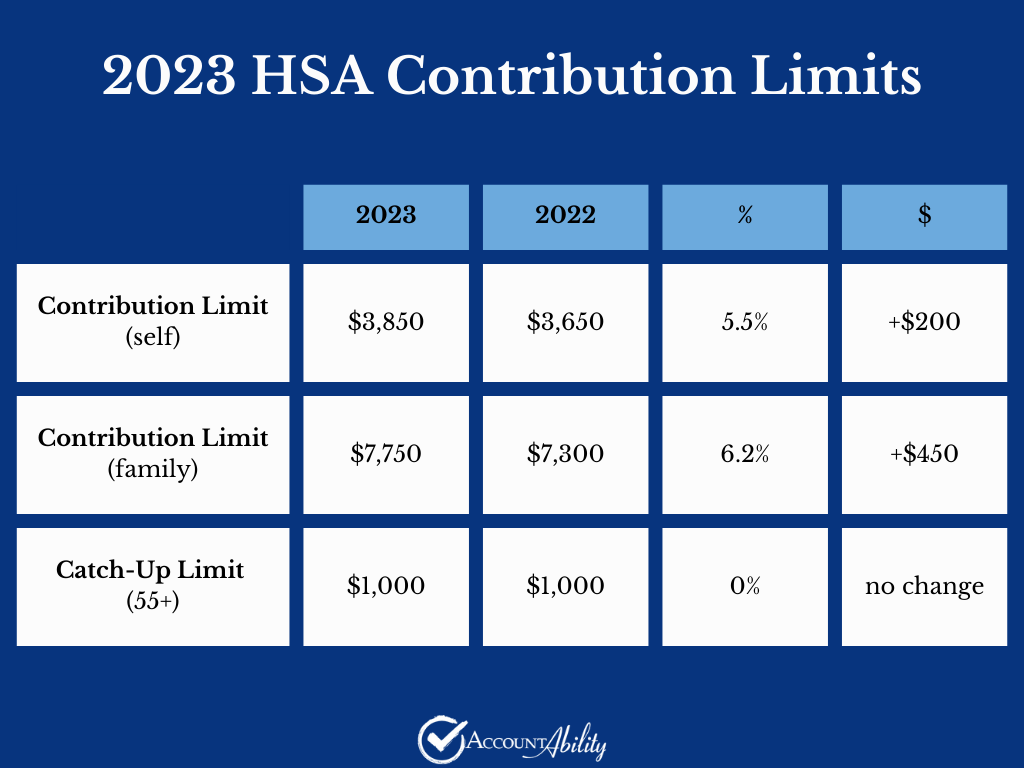

The HSA amounts for this year, 2023, have already been outlined. So let's look at what you can contribute to your account and better understand how you will save money.

The contribution limitations for the upcoming year for single coverage is $3,850, up $200 from the past year. Family coverage has also increased by $450 dollars and is indexed at $7,750. The catch-up amount for taxpayers reaching the age of 55 or older by the end of the year remains at $1000.

Contributions can only be made if you have a high deductible health plan, which, this year, is defined as having an annual deductible that is not less than $1,500 for self-coverage, which has increased by $100 from 2022, and $3,000 for a family plan, up $200 from 2022.

Your annual out-of-pocket expenses, which includes deductibles, co-payments, and other amounts, not including premiums, cannot exceed $7,500 for self-coverage, up $450 dollars from last year, and $15,000 for family coverage, up $900 from last year.

You have until April 15th to put money in your account, so don't wait!

If you would like more information about your health savings account, you can access it on our previous blog titled," You Have Form 5498 and HSA Questions; We Have Answers", or click here for access to a helpful download!